Rob Altenburg, American Rotarian and climate expert speaking to the Rotary Club of Kingston described Bitcoin as both a risky investment financially but more importantly, as a significant threat to our climate emissions goals.

Bitcoin: currency, property or ‘’rat poison’?

According to Altenburg we likely think of Bitcoin as a type of currency; after-all as of this writing, it has a current market cap of $450 billion and is “right up there with the largest corporations in the world.”

But is it currency? The IRS in the USA must not think so but does call it “property”. Financiers like Warren Buffet think not and believe it has no intrinsic value. They believe it is nothing but a financial bubble much like tulip mania of the 17th C. Others have gone so far as to call it ‘rat poison’.

It does, however, have many of the features of currency, says Altenburg. It can be traded; it is portable, and it has aspects of scarcity all of which are features of currency. However, for currency to function, it must be trusted. The US Security and Exchange Commission, along with other countries, is trying to figure out how to regulate it. Certainly, Buffet has no trust in it.

The origins of Bitcoin

Bitcoin arose out of a paper by an unidentified person called Satoshi Nakamoto in 2008.1

The Internet, Nakamoto maintained, requires trust. For example, we pay for goods with credit cards. In return the credit card assumes the risk and extracts a fee from both the customer and the seller for the “trust” it establishes over the transaction. Thus, trust increases the cost, and it also reduces the anonymity which cash provides.

Nakamoto’s solution: “Hashing”

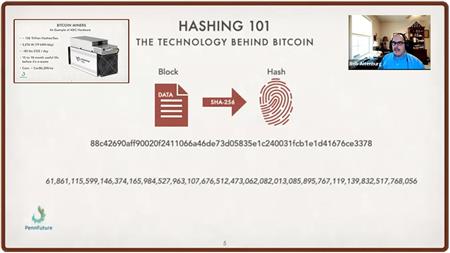

Nakamoto wanted to replace third party credit cards with Cyptographic Proof or simply put, mathematics. His solution was to create something called a Hash. For example, a “block of data,'' such as all the data comprising an e-book. You would then run it through a “Hash’ and it would assign it a number: a very large number in either base 16 (“hexadecimals” i.e., numbers and letters) or base 10 (numbers only). This process is called “hashing”. If you change anything in the e-book, even something as small as a period to a semicolon the entire hash number would change. What you now have a is “fingerprint” of the original e-book and a way of guaranteeing nothing has been changed.

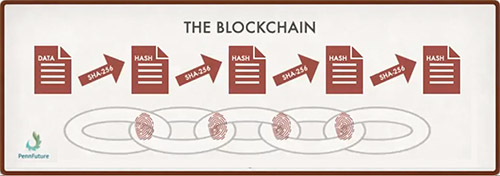

Where it gets complicated is when one hash of data gets linked to another hash of data and so on into what is called a “block chain” or chain of blocks. So, if someone changed that period to a semicolon and wanted to hide it, they would have to also change every block which followed it, a nearly impossible task compared to say normal accounting ledgers in a large company. Another way to think of it is a distributed ledger. Hence security and trust are established through mathematics.

Creating a new block or Data Mining for Bitcoin

Banks create new money by issuing credit cards. Governments create new money by issuing new currency. Bitcoin, is not an entity like a bank, a government or a single corporation like Amazon or Apple. So how do new blocks get created?

Data miners or people who want to create new Bitcoins by Data Mining, arrived at a consensus to use a system based on a single Hash: 256. That is why on the graphic the arrow is labelled SHA 256.

Data miners or people who want to create new Bitcoins by Data Mining, arrived at a consensus to use a system based on a single Hash: 256. That is why on the graphic the arrow is labelled SHA 256.This hash was chosen because it would force Bitcoin to be released very slowly, or as Rob Altenburg termed it, “rate-limited”. This prevents runaway inflation which would make Bitcoin worthless.

SHA 256 is better known as the Proof of Work (POW) algorithm. It was created by Hal Finney in 2004 through the idea of "reusable proof of work" and Bitcoin became the first to adopt its use by consensus in 2009. POW then is a system “that requires a not insignificant but feasible amount of effort to prevent anybody from gaming the system.”

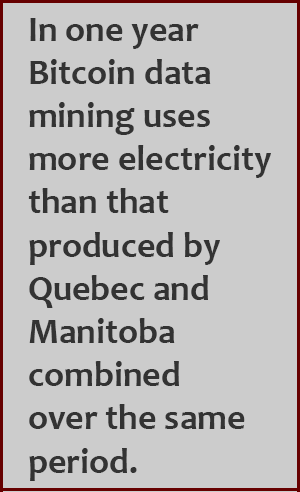

Altenburg calls this being “wasteful by design”. This creates a big problem for Bitcoin because it uses an enormous amount of energy as much as that generated by Argentina for its 45,000,000 people each year and has a huge impact on our effort to reduce carbon emissions and solve climate change.

For example, Altenburg compared the chance of winning LottoMax (1 in 33,294,800) to the chance of creating one new bitcoin block (1 in 104,678,001,670,374,002,800,709) so what miners do is “try lots and lots of blocks really, really fast.”

Data miners began with home computers, then gaming computers. Now they use a piece of hardware called an Application-Specific Integrated Circuit (ASIC) Miners; basically, a supercomputer with integrated circuits designed solely to mine cryptocurrencies. One such computer about the size of a toaster can process about 126 trillion hashes per second but in the process uses 79 kWh/day and creates about 82 lbs of CO2/day.

The problem is compounded because data miners have created huge data farms. Altenburg described one in his state that comprised over 57,000 such ASICs. Worldwide it is estimated that 96 Terawatts/year or more is used to run the World’s, ASICs when trying to mine the blockchains with their highspeed processors. This is more energy than produced by Quebec and Manitoba combined.

How do Bitcoin miners make money?

When a miner or group of miners by chance create a new block, they are paid 6.25 Bitcoins (BTC) which has a value of CAD $173,913 (block 750902 on 2202 08 24). The transaction fee is $475.00. The question is do they make a profit after paying for the electricity and hardware?

Because the costs are very high there is a race to build as many blocks as possible as quickly as possible. At present a new block is created every 10 minutes.

This drives miners to cheap electricity sources in the form of old coal-fired, and fracked gas power plants. fracking wells and well flaring. Bit Miners even have portable generators and data centres that they can set up at a fracking well or well flare, often without permission and then move on when they are discovered. (see Canadian example)

Moreover, even if Bitcoin mining uses low or zero carbon sources of electricity such as nuclear, hydro, wind or solar they are causing pollution because we replace what they use from other polluting sources such as coal fire plants.

They also use other means to increase their profitability. They apply for government subsidies. This can take different forms such as direct spending, forgone revenue, induced transfers or by transferring risk elsewhere.

They also attract investment by offering public shares. One such company told their investors that the public, through subsidies, was paying 60% of their energy costs.

Summary of Issues

In summary Altenburg identified the following key issues with bitcoin mining:

- Pollution

- Carbon

- Toxics, metals, and Acid gasses

- Energy demand and infrastructure

- Noise from the screaming cooling fans

- Economic impacts especially when companies fail

- Lack of consumer protection

What can be done?

In the face of this damning evidence, Altenburg and his colleagues have identified the following policy priorities:

- Ban wasteful Proof of Work process and replace it with less energy demanding system such as Proof of Stake, even though it has its own problems.

- Governments need to stop subsidizing pollution.

- Educate potential investors especially the big institutional investors such as pension plans.

- Educate our policy makers such as government bureaucrats and lawyers as to how Bitcoin and Bitcoin mining and might be regulated or as one Rotarian suggested managed by the governments of the world.

- Educate the public so that they can ask smart questions.

- Ensure that permits are being enforced.

Before asking for questions Altenburg ended his talk with a prediction: “The crash is coming.”

1. Nakamoto, Bitcoin: A Peer to Peer Electronic Cash System, (October 31, 2008)

Rob Altenburg is a member of Mechanicsburg-North (Rotary Club) and ESRAG. Rob has environmental, climate, and energy expertise to advance clean energy solutions. He works with regulatory agencies and clean energy industry experts on climate and energy issues across the Commonwealth. Rob has provided testimony to the US EPA and the White House and co-authored federal climate policy. While working for Environmental Protection, Rob attended Widener Commonwealth Law School in the evenings. He graduated cum laude and earned certificates in both environmental law and administrative/constitutional law.

Watch and Listen to Rob Altenburg's Talk

Further Reading: From Columbia's Climate School - Cryptocurrency's Dirty Secret: Energy Consumption

Added 2022-09-15 The Financial Post The Merge: A blockchain revolution or just more hype?

If you liked this article, please click on the Like button below and please SHARE it on one or all of your social media pages with the other buttons.